How Does KuCoin Futures Work For Crypto Traders Worldwide?

While spot trading allows you to buy and sell at the current market price, futures trading offers a more sophisticated way to speculate on the future price of a cryptocurrency. KuCoin, a globally reco

Understanding the Basics of Crypto Futures

-

Leverage: This is the most significant aspect of futures trading. Leverage allows you to open a position much larger than your initial capital. For example, with 10x leverage and $100, you can control a $1,000 position. While this can amplify profits, it also dramatically increases the risk of liquidation if the market moves against your position.

-

Long vs. Short Positions:

-

Long: A trader who "goes long" believes the price of a crypto asset will increase. They buy a futures contract with the expectation of selling it at a higher price later.

-

Short: A trader who "goes short" believes the price will decrease. They sell a futures contract with the intention of buying it back at a lower price, profiting from the decline.

-

-

Liquidation: This is the point at which your position is automatically closed by the exchange to prevent your account balance from falling below zero. It occurs when your initial margin (the capital you put up) can no longer cover the losses of your leveraged position. KuCoin's platform provides a clear liquidation price, so traders can monitor their risk in real-time.

KuCoin Futures: A User-Friendly Platform for Speculation

-

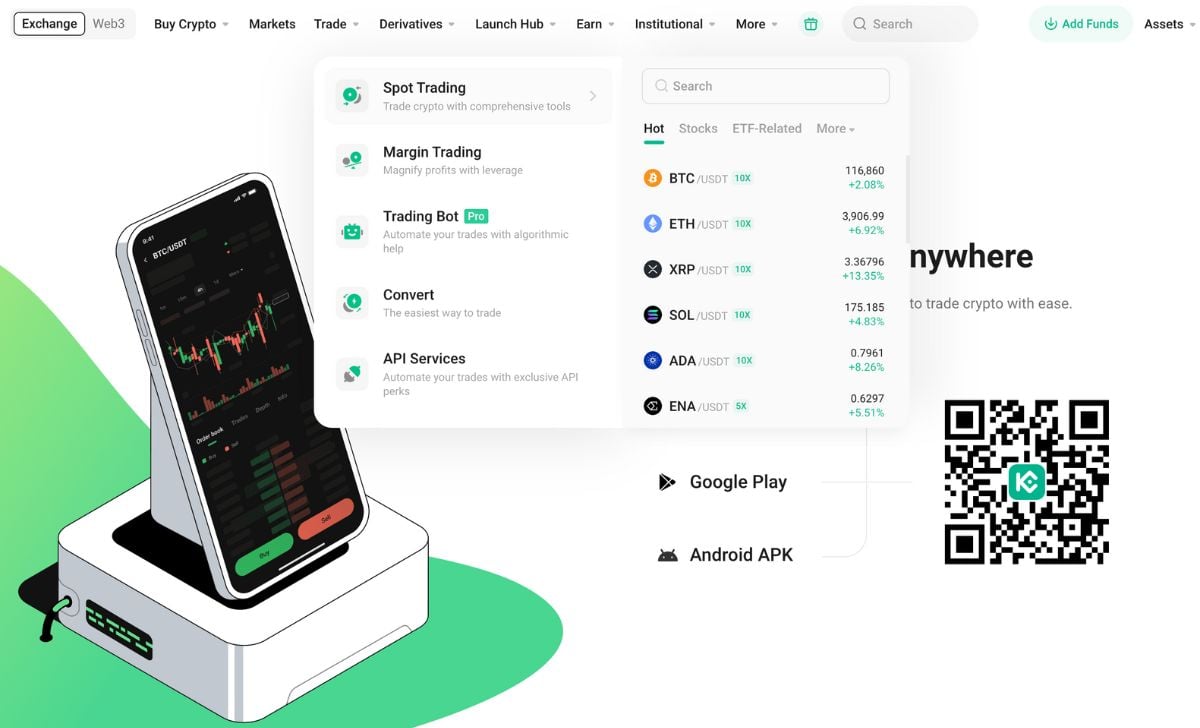

Diverse Contract Options: KuCoin offers a wide range of perpetual futures contracts for popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many others. Perpetual contracts differ from traditional futures because they have no expiration date, making them a more flexible tool for long-term speculation.

-

Cross and Isolated Margin Modes:

-

Isolated Margin: In this mode, the margin for a position is "isolated" from your overall account balance. If the position is liquidated, you only lose the initial margin allocated to that specific trade. This is an excellent way to manage risk on a per-trade basis.

-

Cross Margin: This mode uses your entire futures account balance as margin. If a position faces liquidation, the system will use funds from your other positions or remaining balance to prevent it. This provides more flexibility but also exposes your entire account to risk.

-

-

Advanced Order Types: KuCoin supports various order types to help traders execute their strategies precisely. These include Market Orders, Limit Orders, and advanced options like Stop-Limit and Trailing Stop orders, which help in managing risk and locking in profits.

Strategic Trading on KuCoin Futures

-

Start Small: If you're new to futures, begin with a small amount of capital and low leverage. This allows you to get a feel for the market and the platform without risking a significant portion of your portfolio.

-

Use Stop-Loss Orders: A stop-loss is an order to automatically close your position when it reaches a certain loss threshold. This is a crucial risk management tool that protects you from catastrophic losses.

-

Stay Informed: The crypto market is highly volatile. Stay up-to-date with market news, technical analysis, and sentiment to make informed trading decisions.

-

Practice on the Testnet: KuCoin offers a test environment where you can practice futures trading with virtual funds. This is a perfect way to test your strategies and get comfortable with the platform without any financial risk.

Rewards and Incentives: Beyond Trading

Conclusion

Remplacez les images

Remplacez les images

Remplacez les textes

Remplacez les textes

Personnalisez !

Personnalisez !